Posts Tagged ‘Investing’

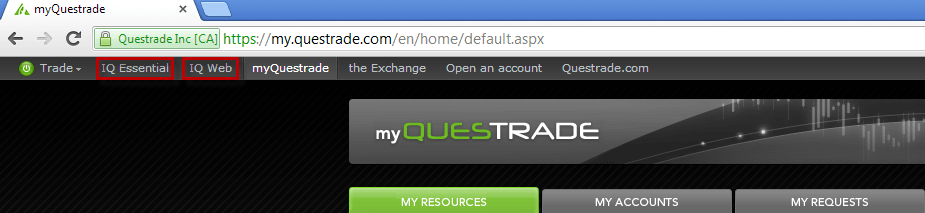

Questrade Tutorial: How To Use The Trading Platform

Questrade is best known for offering rock-bottom commissions for trading stocks. You can buy and sell individual stocks for as low as $4.95 per trade. Questrade even introduced commission-free purchases for any ETF in North America. You can open your own self-directed investing account with Questrade with as little as $1,000. Unlike the big discount…

Read MoreHow Index Funds Compare To Equity Mutual Funds

This article was originally published more than seven years ago and remains of the most widely read investing pieces on Boomer & Echo. I’ve updated the 10-year returns of the funds listed below. Not surprisingly, the returns of low cost index funds still beat the more expensive equity funds. Despite numerous studies showing that Canadian…

Read MoreSh*t My Advisor Says

Some investors eventually leave their commission-based advisors and opt to set-up a simple portfolio of index funds or ETFs on their own. There are plenty of compelling reasons to do so; the reduction in fees alone can save investors thousands of dollars a year, and academic research shows that the lower your costs, the greater your share of…

Read MoreEngineering A Better Outcome For Investors

When I worked in the hospitality industry our hotel group placed a large emphasis on the profitability of its restaurants and catering departments. Considerable effort was made to drive overall food costs down while at the same time creating a sales culture that pushed the highest margin items to boost revenue. One of the most effective ways…

Read MoreThe Problem With Core And Explore

A core and explore investing approach can give you a taste of both passive and active strategies. The idea being that you put 90 percent of your portfolio into a low-cost, broadly diversified set of index funds or ETFs, and then put the remaining 10 percent of your portfolio into investments that have potential to…

Read MoreSteak Knives, Yes. Financial Advice, Maybe Not.

When I was younger I had the opportunity to work for Vector Marketing, the sales arm of Cutco Corporation and the maker of Cutco cutlery – speciality knives with a forever guarantee. The job listing said no experience necessary and it wasn’t all commission-based – you received a guaranteed base rate of pay every time…

Read MoreHow To Invest Like A Pro

I began working in the financial services industry when I was 24 years old. A few – um – decades later, I feel I have learned a thing or two. However, like others who have been in a particular career for a length of time (I’m thinking here specifically of anyone who works with computer software,…

Read MoreInvestment Return vs. Investor Return: How Did Your Portfolio Stack Up In 2016?

It’s been two years since I sold all of my Canadian dividend stocks and switched to a two-ETF investing solution in my RRSP. I love the hands-off approach, capturing market returns minus a very small fee, plus the instant diversification of owning thousands of stocks from around the world with just two funds. The downside…

Read MoreCommission-Based Advice and Suitability: A Dangerous Combination for Canadian Investors

The average Canadian investor has little clue how their financial advisor gets paid, or that their advisor is only obligated to provide advice and product recommendations that is suitable, but not necessarily in the best interests of their clients. Commission-based advice Why does this matter? Commission-based advice leads to conflicts of interest. Namely, advisors who…

Read MoreFinancial Planning For Couples: Starting To Invest

You should by now have spent some time as a couple prioritizing your goals and using the appropriate savings vehicle for your short and medium term goals. How far you need to go (your goal), and how much time you have to get there will determine the most suitable vehicle within your level of tolerance for…

Read More