Net Worth Update: 2025 Mid-Year Review

Happy Canada Day! It has been an absolute rollercoaster of a year so far. Canadian and US stocks started the year hot before plunging by 13% and 20% respectively from the end of January to the beginning of April. Now we’re back to all-time highs again as global stocks have soared by 20% since April.

Our investment portfolios are large enough now that one bad day in the market (-5%) means a paper loss of ~$70,000. But the flip side is true as well. Strong market returns can contribute much more to our overall net worth at this stage than our savings contributions ever could.

In our own personal finances we made the decision to finally switch up our compensation from all dividends to a mix of salary and dividends. This will allow us to pay into CPP, generate RRSP room for future contributions, and avoid potential tax landmines in our corporation if active and passive income continues to grow.

That decision will impact our previously stated goals for 2025 – but long-term it’s for the best.

As I’ve written before, we have six financial goals for the new year:

- Contribute $28,000 each to our TFSAs (TFSA snowball)

- Contribute $5,000 to our kids’ RESP in January and rebalance the portfolio for their age 16 and 13 years.

- Take three trips (Cancun in February, Italy in April, and Scotland in the summer).

- Earn enough business revenue to meet our personal income needs (same as 2024) and contribute $80,000 to our corporate investments.

- Pay for bi-weekly cleaning, summer lawn care, and winter snow removal to allow more time for work, leisure, and family.

- Reach the $2M net worth milestone (a stretch goal that is only possible with another strong year of market returns).

We have each contributed $12,000 to our TFSAs so far this year, so we’re a bit behind. That said, the first half of the year tends to be more expensive with more money allocated to travel (buying flights, train tickets, putting deposits on Airbnbs, etc.) and annual property taxes. We are on track to actually increase our TFSA contributions to $32,000 each by year-end.

Our kids’ RESP was maxed out in January and I rebalanced the portfolio according to our modified Justin Bender investing approach (for the most difficult account to manage). We also (finally) moved the RESP in-kind from TD Direct Investing to Wealthsimple.

We enjoyed a sunny holiday in Cancun over the kids’ February break, and had a lovely Easter break visit to Italy. Scotland is next this summer, and we can’t wait to get back to explore more of the Highlands.

As mentioned, our compensation structure has changed so we’re now paying ourselves a mix of salary and dividends. That will mean less money going into corporate investments (target is now $55,000) and more will be coming out personally to fund TFSA and future RRSP contributions.

Bi-weekly cleaning has been a blessing over the past two years in our new (larger) home. It’s so nice to have the floors and bathrooms cleaned on a regular basis so we can just focus on general tidiness.

It didn’t snow much this winter, but I did pay for shovelling a couple of times when we were away.

I did finally cave and pay for summer lawn care, which has freed up more time to spend with family on the weekends.

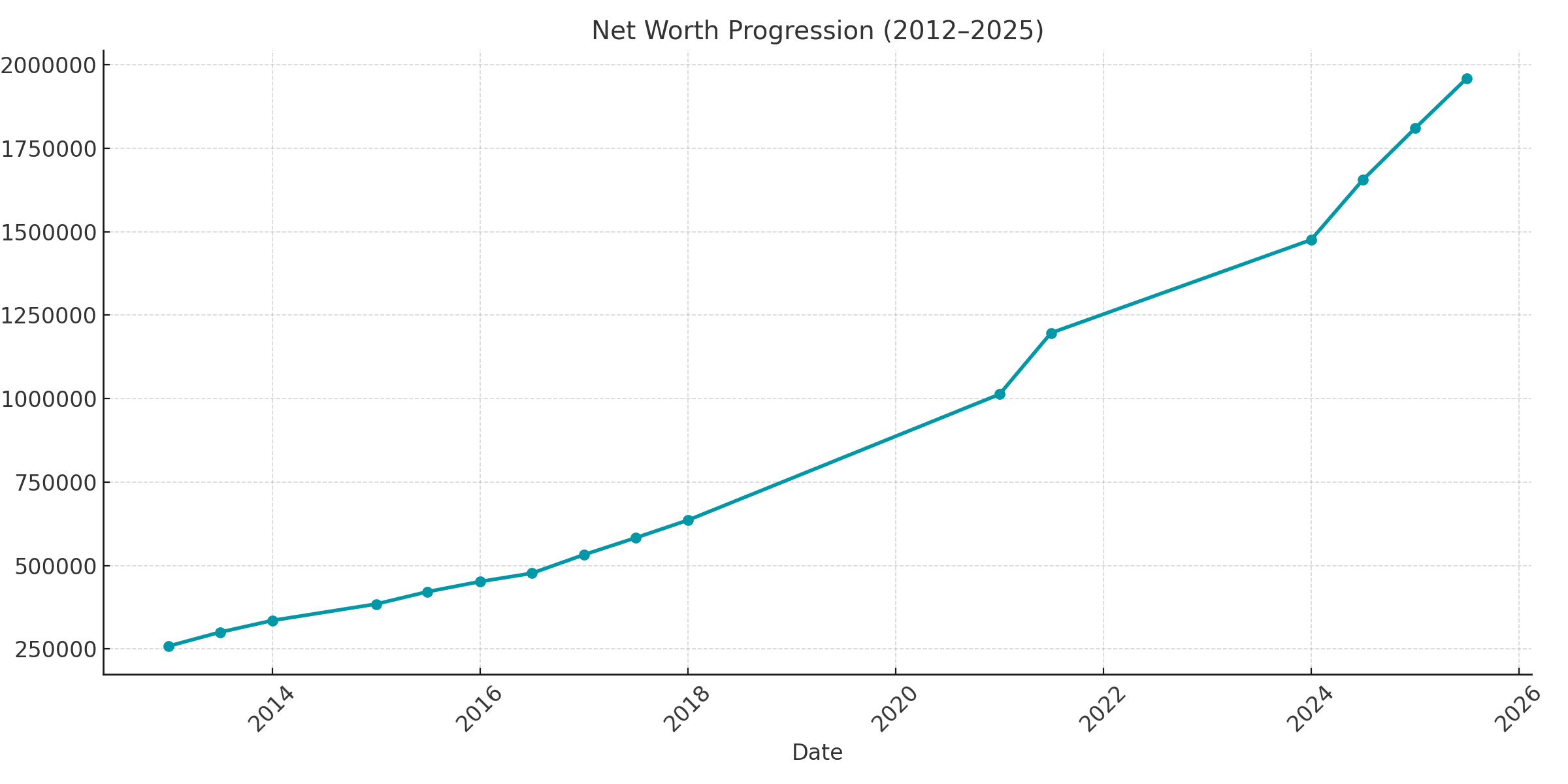

We crossed the million-dollar net worth threshold at the end of 2020. In that update, I haphazardly set a big hairy audacious five-year goal:

“What’s next after reaching the $1M milestone? They say the first million is the hardest, so why not aim for $2M by the end of 2025 (my age 46 year)?”

After “Liberation Day” I thought it would be quite a stretch to hit that $2M mark by year-end. But here we are half-way through 2025 and we are oh-so-close.

Net worth update: 2025 mid-year review

Total Assets – $2,430,444

- Chequing account – $12,000

- Corporate cash – $60,000

- Corporate investment account – $491,340

- RRSPs – $407,329

- LIRA – $270,298

- TFSAs – $80,925

- RESP – $132,552

- Principal residence – $976,000

Total Liabilities – $470,988

- Mortgage – $470,988

Net worth – $1,959,456

Now let’s answer a few questions about the way I calculate our net worth:

Credit Cards, Banking, and Investments

We funnel all of our purchases onto a few different rewards credit cards to earn points on our everyday spending.

Our go-to card is the American Express Cobalt Card, which we use for groceries, dining, and gas. We also look for the best credit card sign-up bonuses and time our large annual spending (car and house insurance) around these offers. One I’m using currently is the American Express Platinum Card.

We’ve nearly broken all ties with our long-term banking relationship at TD. We’re down to our joint chequing account, our small business chequing account, and our kids’ personal accounts. My wife has her own chequing and savings accounts at Tangerine.

Our RRSPs, TFSAs, RESP, and my LIRA are held at the zero-commission trading platform Wealthsimple Trade. Our corporate investment account is held at Questrade.

You know all of this from my post about how I invest my own money.

RRSP / LIRA / RESP

The right way to calculate net worth is to use the same formula consistently over time to help track and achieve your financial goals.

My preferred method is to list the current value of my RRSP, LIRA, and RESP plans rather than discounting their future value to account for taxes and distributions.

I consider a net worth statement to be a snapshot of your current financial picture, so when it comes time to draw from my RRSP/LIRA and distribute the RESP to my kids, my net worth will decrease accordingly.

Principal Residence

We bought our home last year for $976,000, so that’s the price I’m using for our net worth calculation. I typically adjust the purchase price by inflation each year but I’ll likely keep listing it at the purchase price for a few years.

Astute readers will notice that the price of our previous home went from $459,000 to $555,000 from 2021 to 2022. That ended up being the sale price, so you can see that I was pretty conservative with the house value over the years.

Final Thoughts

They say what gets measured gets managed. We started posting our net worth updates in 2012. Back then our net worth was just a touch over $250,000 and comprised mostly of our home equity.

The goal was to move the needle forward each year and build that “up-and-to-the-right” momentum.

What a difference you can make in just 10-12 years with measurable financial goals, a plan to achieve them, good savings habits, and by investing wisely.

We’re looking forward to our summer adventure and then finishing out the year strong. While we’re on track to reach our big hairy audacious goal, markets willing, we recognize that it’s just a headline number – a vanity metric, if you will.

We’re incredibly fortunate to make a good living in a business we love, working from home and spending as much time with our kids both here and travelling around the world. We don’t take that for granted for one second.

How is 2025 shaping up for you so far? Let me know in the comments.

Thank you love reading your content and net worth updates and am very happy to see your family achieve it’s goals.

Thanks for the kind words, Anja!

Great article and congratulations on being so close to your BHAG…. Great demonstration of continuing to adjust to life while keeping your eye on the ball.

A question for you – when in receipt of a defined benefit pension is there any point in determine an implied value as part of a net worth calculation or is it a case of comparing apples and oranges?

Hi Geoff, thanks!

For a DB pension I would run a present value calculation with the inputs being your annual pension, the number of years paid (if you’re 60 and expect to live to 90 then use 30 years of payments), and if your pension is indexed to inflation then input an interest rate (ex. 2.1%).

A $60,000 pension paid for 25 years with a 2.1% interest rate would give you a present value of $1.16M.

https://www.calculator.net/present-value-calculator.html

Great progress! May I ask why you include the RESP in your net worth calculation?

Hi David, it’s our savings contributions filling it up, and the account technically belongs to us if our children do not attend an eligible post-secondary institution. If/When they do and we use the funds to pay for their education, our net worth would decrease accordingly.

Without knowing the Income it is hard to gauge if your doing well. Looks like you have substantial Income.

Hi Doug, that would be an astute observation. Income has increased substantially since leaving my T4 salaried job at the end of 2019.

I’m with you all the way… almost. I choose not to use American Express products and forgo the extra rewards in the interest of keeping my spending Canadian! Canada Proud!

Hi Max, that’s perfectly sensible. Someone had a similar argument about choosing to invest in BMO’s all-in-one ETFs instead of Vanguard’s or iShares’. I’m not planning to do that, but I respect the idea.

Life can change in the blink of an eye. I finally retired in January, took an amazing South American vacation, came home and 2 weeks later our 40 yo son died in an accident. We are now caring for our grandchild, so many of the beautiful retirement plans are shelved for a few more years. Love our grandchild to death. I’m only mentioning this because you need to expect the unexpected.

Oh, and if anyone doesn’t have a will, go call your lawyer today!

With all my heart, I wish you peace…My most sincerest condolences.

I too am sorry to read of your sad news, Pat. I wish you and your family the strength to carry on, honouring your son by lovingly caring for your grandson.

Oh Pat, I’m so sorry for your loss. Wise words about expecting the unexpected and to make sure you have a will in place.

Wishing you all the best!

Awesome post on setting a target and consistently and slowly getting there. Great to see the “fruits” of compound interest now has the biggest effect on the finances and I’ll celebrate when you get to $2,000,000.

Looking forward to the next big hairy goal!

5 years from 1-2 million.

How long till 3?

Cheering you on!

Hi Ravi, thanks – it really is amazing to see the power of goal setting, discipline, and time to stick to your plan.

I think I’ll end the net worth updates after (hopefully) reaching the $2M milestone at the end of this year. We’re at a different phase of life right now, having achieved a level of comfort and freedom that we never thought possible at this stage. We’re less focused on the next number, and more about finding and funding a good life.

Makes sense, Robb. I can see us following your footsteps here.

At a certain age, you chase the number and the stability.

Then it’s off to the next challenge 🙂

The “Rich Life,” as Ramit Sethi would say, awaits.

But, you have earned it!

I totally get that everyone wants to have enough to live comfortably in their retirement years and a financial plan provides the roadmap. No one wants to be “caught short.” Blogs like this one also help us to negotiate the curves and bumps along the way.

But sometimes I have to wonder when does enough become exactly that?

Trump seems hellbent on becoming wealthier and wealthier, even using his office to generate more and more money for himself, his family, and friends.

Is wealth accumulation addictive, then?

Hi Tom, it’s a fair point. When asked how much money is enough, John D. Rockefeller famously quipped, “just a little bit more.”

PWL Capital’s Finding and Funding a Good Life paper is worth a read: https://pwlcapital.com/finding-and-funding-a-good-life/

“There is a lot more to a good life than wealth accumulation and risk-adjusted returns. A good life is, of course, subjective, but research across economics and psychology provide a starting point. Framing financial decisions through the lens of living a good life, measured by life satisfaction, rather than dollars in your bank account or other material possessions, is likely to lead to better outcomes.”