Personal Finance

Financial Conflicts: When A Spender Partners With A Saver

As part of my budgeting plan, I transfer a set amount every month into my chequing account to pay for the household bills and regular monthly spending. I have this figured out pretty accurately. This month, I was pleasantly surprised to see that I had almost $700 extra – money that wasn’t spent. I told…

Read MoreComparing Birthday Parties for Kids: Gymnastics Centre vs. McDonald’s

Like many parents of school-aged children, our kids regularly attend or get invited to birthday parties for their friends and classmates. We’ve noticed more and more of these birthday parties for kids are being held at an all-in-one facility such as a gymnastics centre, trampoline park, or other play centre. The children play run around…

Read MorePersonal Banking Options For Seniors

When my husband turned 60 I was eager to have our banking switched to a seniors plan with all the accompanying benefits. When I worked at the bank that I currently deal with, customers were automatically enrolled into “Plan 60” on their 60th birthday. This meant all kinds of perks including no-fee chequing, drafts and money…

Read MoreSudden Money: How To Manage A Financial Windfall

Odds are that at some point you will receive a financial windfall. Windfalls can come from lots of different sources; inheritance, divorce settlement, insurance proceeds, sale of small business, severance or retirement package and, yes, a lottery win. It may seem like a problem you’d love to have, but it can be life changing, and…

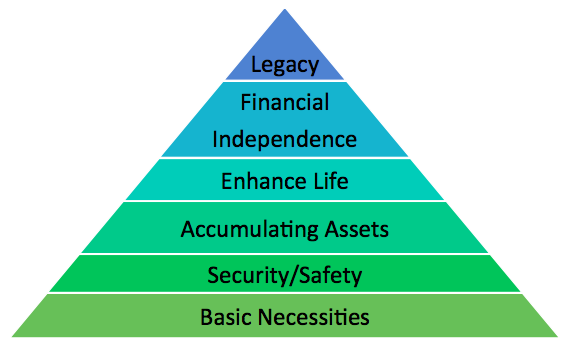

Read MoreThe Hierarchy Of Financial Needs

If you’ve ever taken a psychology course you may be familiar with Abraham Maslow’s Hierarchy of Needs. In ascending order, the needs are: Physiological Safety Social / Belonging Esteem / Achievement Self-Actualization / Reaching your potential The theory states that people need to fulfill their basic needs before devoting energy to the higher levels. So,…

Read MoreA Financial Success Plan For New Graduates

All across the country, university and college students are finally donning their robes and mortarboards and stepping across the stage to receive their diplomas. It’s an exciting time. For many new graduates, it may be the first real taste of independence – finding a job, a place to live, paying off those student loans. It…

Read MoreTry A 30-Day No Spending Challenge

The rule is simple. Cut out all non-essential spending for one month. No dining out. No trips to the craft or home improvement store. No new clothes or gadgets. No movie theatre, local pub, or sports event. Absolutely no credit card purchases. You still need to pay your normal bills – rent or mortgage, utilities,…

Read MoreTaking Out A Second Mortgage: A Cautionary Tale

Let me share a cautionary tale about taking out a second mortgage. I got into a lot of financial trouble in my early twenties. Even though I bought my first home on my own at 23, my finances were a mess and I was stuck in a big-time credit card debt trap. My only saviour…

Read More5 Ways To Avoid Monthly Bank Fees

I’ve banked with TD my whole life but while I consider myself to be a fairly loyal customer that doesn’t mean I’ll blindly accept blatant fee grabs without fighting back. That’s exactly what happened two years ago when the big green bank announced changes to its chequing account fees and minimum balances. Their basic chequing…

Read More7 Money Mistakes To Avoid This Year

I’m on a mission to help people get a better handle on their money. Of course, you may be someone who doesn’t make mistakes. However, in the thirty plus years I’ve worked in the financial services industry, I’ve seen lots of things that people do wrong when it comes to their money. This is a…

Read More