Investing

Are ETFs Becoming Too Complex?

Exchange traded funds have surged in popularity as more investors realize the benefits of lower investment costs and broad diversification. They started out as a way for investors to tap into the returns of major stock markets using a nice convenient low-cost package that trades like a stock. With passive investment management, a computer could…

Read MoreThe Misguided Beliefs of Financial Advisors

Critics of the investment industry, me included, often point to conflicts of interest that lead to higher costs and poorer outcomes for investors. Indeed, a 2015 study on mutual fund fees conducted by the Brondesbury Group determined that financial advisors who receive commissions from selling mutual funds are often biased in selecting funds that offer…

Read MoreEngineering A Better Outcome For Investors

When I worked in the hospitality industry our hotel group placed a large emphasis on the profitability of its restaurants and catering departments. Considerable effort was made to drive overall food costs down while at the same time creating a sales culture that pushed the highest margin items to boost revenue. One of the most effective ways…

Read MoreA Robo Investing Solution For Affluent Investors

Robo-advisors have been around for several years now in Canada offering affordable online investing services with a light human touch. You might picture the typical client as a smart young millennial just beginning his or her investing journey. After all, that’s how robo-advisors are often portrayed in the media. But it might surprise you to…

Read MoreIs Fear Keeping You Out Of The Stock Market?

The biggest concern for many investors is the fear of losing their money. The stock markets have shown some volatility the last week or so, and the recent screaming headlines in the financial media do nothing but encourage panic. Some people think the latest bull market has overvalued stocks and a major market meltdown is…

Read MoreWorst Day Ever?

Will Monday February 5th go down as the worst day ever for stocks? On this day the Dow Jones industrial average lost more than 1,175 points – the worst single-day point drop in its history. But was it really the worst day ever? Investors need some context. The 1,175 point drop was indeed the biggest…

Read MoreReady to Join The ETF Movement? Here Are 4 Tips To Get Started

2017 was a good year for the Canadian ETF market, with total assets reaching nearly $146 billion at year-end. While a far cry from the $1.48 trillion that Canadian investors held in mutual funds, it still represents 28 percent growth for ETFs in Canada. BlackRock’s iShares dominates the Canadian ETF market, boasting a 40 percent…

Read MoreFinding Patterns To Predict The Stock Market?

We all know about the economic cycle, the natural fluctuation of the economy going from growth, peak, contraction and trough. It looks like the bell curve you’re familiar with from school. Apart from that, millions of investors are still trying to discover a formula for timing the stock market by finding patterns. But, in any…

Read MoreBuilding Your Wealth: Alternative Investments

Most investments are grouped into the three traditional asset classes of stocks, bonds, and cash or cash equivalents. There are also alternative investments such as real estate, commodities, collectibles, art, and antiques which operate far differently and require more investigation, expertise and each has specific risks. Building Your Wealth with Alternative Investments Real estate Real…

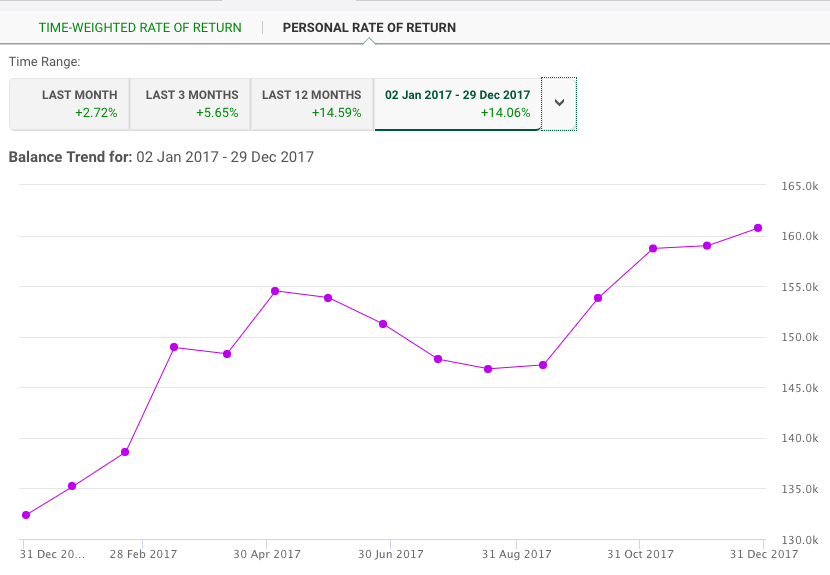

Read More3 Years Ago I Switched To Indexing. Here’s How My Portfolio Performed

On January 7th, 2015 I sold 24 Canadian dividend stocks worth about $100,000 and bought two low-cost index ETFs (Vanguard’s VCN and VXC). It was a bold move to switch to indexing after years of dividend growth investing. Lots of people questioned my decision. I even lost blog readers because of it (seriously). But it…

Read More