Investing

The Pitfalls Of Commission-Free Trading

The evolution of self-directed investing through discount brokerage platforms has driven the cost per trade down from $29 a decade ago to $9.99 at big bank brokerages today. Some discount brokers (like Questrade) offer free ETF purchases, and one platform – Wealthsimple Trade – even offers commission-free trading of stocks and ETFs with no account…

Read MoreChanging Investment Strategies After A Market Crash

Investors should take great care to choose an investment strategy they can stick with for the long term – in both good times and bad. The problem is we make our decisions about risk tolerance and asset allocation in a vacuum. Our retirement portfolio isn’t at stake when we fill out a questionnaire. Then markets…

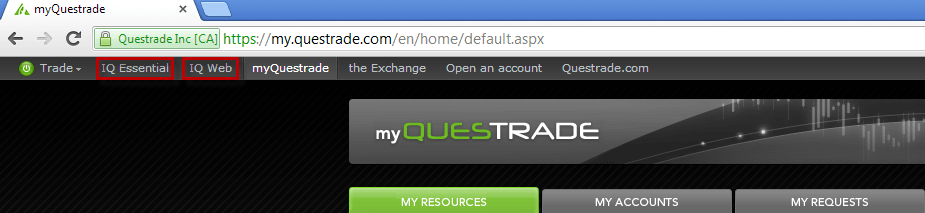

Read MoreQuestrade Tutorial: How To Use The Trading Platform

Questrade is best known for offering rock-bottom commissions for trading stocks. You can buy and sell individual stocks for as low as $4.95 per trade. Questrade even introduced commission-free purchases for any ETF in North America. You can open your own self-directed investing account with Questrade with as little as $1,000. Unlike the big discount…

Read MoreMy Mortgage Gambit: How (And Why) I Loaned Myself A Mortgage From My LIRA

This is a reader story from Kevin in Toronto, who, after getting laid off, took an unconventional approach with his locked-in retirement account (LIRA) – paying off his mortgage and then setting up a LIRA mortgage. What are the pros and cons of loaning yourself a mortgage from your RRSP or LIRA? Read on for…

Read MoreHe Bet The Farm On Weed Stocks And Won. Then Watched It Burn To The Ground

The following story is from Nick, whose investing journey began when he bet the farm (and won) on weed stocks, then watched in horror as that same barn burned to the ground several months later. You can follow his portfolio and journey for redemption at LateCycle.com – or on Twitter (@latecycle_nick). It’s one o’clock in the…

Read MoreNo, Passive Investing Is Not In A Bubble

There have been many ridiculous statements made about passive investing over the years. None have garnered as much media attention as hedge-fund manager Michael Burry’s claim that passive investments such as index funds and ETFs are the next bubble. He said these index-tracking investments are “inflating stock and bond prices in a similar way that…

Read MoreHow Index Funds Compare To Equity Mutual Funds

This article was originally published more than seven years ago and remains of the most widely read investing pieces on Boomer & Echo. I’ve updated the 10-year returns of the funds listed below. Not surprisingly, the returns of low cost index funds still beat the more expensive equity funds. Despite numerous studies showing that Canadian…

Read MoreAn Easy Way To Invest Responsibly

This post is sponsored by RBC InvestEase Inc. All views and opinions expressed represent my own and are based on my own research of the subject matter. Responsible investing is something on the minds of many investors today. They’re concerned about the environmental, social, and governance (ESG) aspects of economic activities. Once considered a fringe movement, retail…

Read MoreVBAL vs. Mawer Balanced Fund For One-Stop Investing

Investors could have done a lot worse over the past 30 years than investing in the Mawer Balanced Fund. Mawer, which epitomizes the art of boring investing, has been nothing short of consistently brilliant – with annual returns of 8.5 percent since the fund’s inception in 1988. Investment giant Vanguard doesn’t have the same longevity…

Read MoreWhen Investment Returns Are So Bad They Make GICs Look Good

The research firm DALBAR has been studying the behaviour of mutual fund investors for 25 years. Each year the firm reports how poorly investors fared relative to their benchmark index over time. What the data repeatedly shows is a ‘behaviour gap‘ that leads to significant investor underperformance. It suggests that investors lack the patience to…

Read More