Investing

From The Boomer & Echo Mailbag: The Role Of Fixed Income In A Portfolio

Q. I understand that to have a properly balanced account around half of our investments should be in fixed income products. However, most bonds have a ridiculously low return. GICs are an option, as are high interest savings accounts. Are there better solutions? I know it’s difficult to hold on to low paying fixed income…

Read MoreIt’s Time To Overhaul The Finance Industry

Canadians have been abuzz with the news of shady bank practices and the “what’s in a name?” controversy over advisors vs advisers instigated by the CBC. But the real problem is how the entire financial industry is regulated. Provincial regulators need to overhaul the requirements for the financial industry to better protect investors. Sure, they’ve…

Read MoreBuilding Your Wealth: Employee Stock Purchase Plans

I regret to say I didn’t participate in my employer’s pension plan. However, I did join the employee savings plan – now called employee stock purchase plans. The resulting investment eventually became the backbone of my retirement plan. Many employers have stock plans that allow their employees to purchase shares in the company at a…

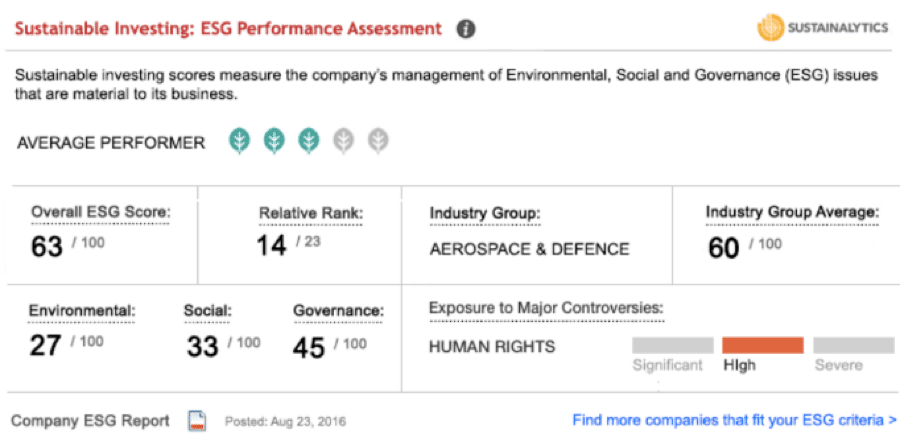

Read MoreA New Way To Look At Sustainable Investing

It’s not often we can equate green and sustainable business practices with the oil and gas sector but at a recent leadership summit I had the pleasure to hear Imaginea Energy founder Suzanne West share her ambitious vision to ‘green’ the oil business. Ms. West attended Richard Branson’s leadership gathering at Necker Island where she…

Read MoreGrowing Your Wealth: Managing Investment Fees

Effective January 1, 2017, new rules compel investment firms and advisors to clearly outline the costs of any funds held by their clients. Previously, many investment fees were hidden within incomprehensible prospectuses and financial reports that most investors rarely read. How do the various fees you pay on your investments – whether you do it…

Read MoreWhy I Don’t Invest In A Taxable (Non-Registered) Account

Rumours of an increased capital gains tax were put to rest last week when the Liberals unveiled their second federal budget with no mention of a change to the inclusion rate. The scuttlebutt around capital gains, however, got me thinking about investing in a taxable or non-registered account. There are several scenarios where investing in…

Read MoreGood Riddance To Deferred Sales Charges

As of January 1, 2017, Investors Group has eliminated deferred sales charges (DSC) on all new lump sum investments to their funds. The good news is that dropping the DSC is part of a new trend by investment brokers to replace this archaic charge for withdrawing your own money with a more up front fee-for-advice…

Read MoreChecking In On Fraud Prevention Month

March is Fraud Prevention Month in Canada and the Alberta Securities Commission (ASC) wants investors to be on alert for any potentially fraudulent schemes disguised as too-good-to-be-true investment opportunities. To show Albertans how easy it is to become a victim of investment fraud, the ASC orchestrated a scheme of its own to raise awareness about…

Read MoreWhy My Four-Minute Portfolio Is Tough To Beat

I spent a total of four minutes working on my RRSP portfolio last year. It wasn’t benign neglect – my two-ETF all-equity portfolio really is that simple! I made four trades, which took about a minute each after determining how much money to invest, in which of the two ETFs to allocate the investment, and…

Read MoreAsking The Wrong Questions About Your Investing Strategy

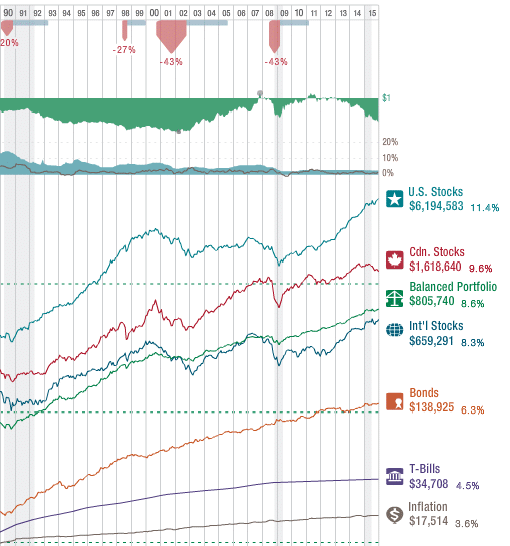

If you’re anything like me you started investing because you wanted to make money and the stock market just happens to be the best place to achieve inflation-beating returns over the long term. Investors must accept, however, that greater returns come with greater risk, along with the possibility that your portfolio might suffer losses of…

Read More