Investing

Working With The Right Financial Advisor

When I was growing up, my dad used to do his own car maintenance – changing the oil, spark plugs and air filter, and flushing the radiator. He taught my brother how to do these chores so he could save money. Now vehicles have become a lot more complicated and not many people do their…

Read MoreBanning Commissions Won’t Lead To An Advice Gap Because Small Investors Already Get Screwed

The investment fund industry would have you believe that banning embedded commissions – or trailer fees – on mutual funds will create an advice gap. The thought being that a commission ban will cause thousands of financial advisors to flee the industry and leave small investors, those with portfolios under $100,000, without access to quality financial advice.…

Read MoreGauging Investment Knowledge: Is It Time To Fire Yourself, Or Your Advisor?

It has become increasingly important for individuals to become financially knowledgeable and to be able to plan and manage their financial assets, and especially, to be able to save and invest for their retirement years. Complicating matters is the shear volume of financial information accessible to retail investors, and the large number of investment options…

Read MoreHave We Reached Peak Stock Market?

The stock market has been full-on raging bull since March 2009. Indeed, the S&P 500 bottomed-out at 682 in the depths of the great financial crash, but has since climbed to a record 2,415 as of this writing. Those who started their investing journey in the past eight years have only known markets to rise, but prices…

Read MoreInvesting For Income In Your Accumulation Years

When I sold my dividend stocks in 2015 my portfolio was worth $100,000 and generated about $4,000 a year in dividend income. I’ll admit it was motivating to watch the dividends grow each year as I added new money to my portfolio and companies increased their payouts. I regularly tracked my progress and projected out…

Read MoreKnow Your Client: The Importance of an Accurate KYC

According to IIROC (Investment Industry Regulatory Organization of Canada), more than half of the complaints they receive are about investment issues – in particular, unsuitable investments. Many of these problems can be avoided with an accurate “Know Your Client” (KYC) document in place. This document is not just another piece of administrative paperwork. It is…

Read MoreHow CDIC Would Protect Your Deposits If Home Capital Goes Bankrupt

Canada has not seen a bank failure since Security Home Mortgage Corporation, a Calgary-based company, went bankrupt in 1996, putting $42 million in bank deposits at risk. Two decades later we have another mortgage company, Home Capital Group, teetering on the brink of bankruptcy. Deposits at Home Capital were expected to fall to $192 million this week,…

Read MoreForget the Excuses. Here’s a Brain-Dead Easy Way to Start Investing

Many people know they should invest for the future but for one reason or another the investing can gets kicked down the road. Maybe they’re living paycheque to paycheque and can’t free up enough cash to invest, or they simply don’t have time to make an appointment with an advisor to draw up an investment…

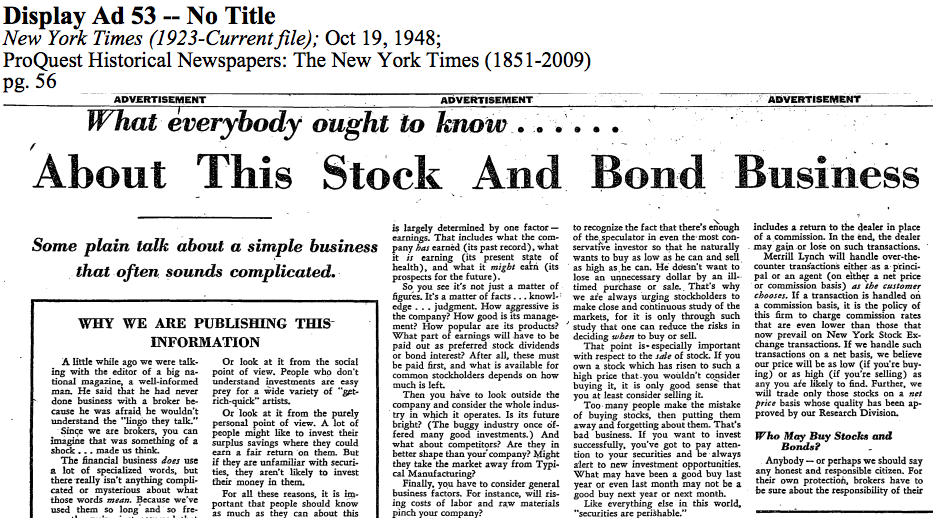

Read MoreWhat Everybody Ought To Know About This Stock And Bond Business

Back in 1946, a man named Louis Engel was hired to run the advertising and promotions at Merrill Lynch. Engel’s unorthodox approach to advertising resulted in thousands of leads for Merrill Lynch brokers nation-wide. How did he turn the investment industry on its head? By taking the investment broker lingo out of its advertisements, simplifying the message,…

Read MoreThe Biggest Lie in Investing: Protection on the Downside

Imagine for a moment that you’re a small business owner in your late forties. Over the years you’ve worked hard to build up your company; a strip mall that consists of a car wash, gas station, and liquor store. With most of your assets tied up in the small business you don’t have much else in terms of…

Read More