Steak Knives, Yes. Financial Advice, Maybe Not.

When I was younger I had the opportunity to work for Vector Marketing, the sales arm of Cutco Corporation and the maker of Cutco cutlery – speciality knives with a forever guarantee. The job listing said no experience necessary and it wasn’t all commission-based – you received a guaranteed base rate of pay every time…

Read MoreWeekend Reading: Income Sprinkling Edition

This week Federal Finance Minister Bill Morneau took aim at a tax strategy used by small businesses and private corporations called income sprinkling. Under current rules, anyone who owns shares in a private corporation can receive dividends without having to actual contribute to the business. Small business owners use dividend sprinkling to pay their lower…

Read MoreComparing Birthday Parties for Kids: Gymnastics Centre vs. McDonald’s

Like many parents of school-aged children, our kids regularly attend or get invited to birthday parties for their friends and classmates. We’ve noticed more and more of these birthday parties for kids are being held at an all-in-one facility such as a gymnastics centre, trampoline park, or other play centre. The children play run around…

Read MoreHow Much Do You Need To Save For Retirement?

In your 20’s and 30’s, retirement is so far away that you can barely see it on the horizon. The best way to get there is to save what you can afford – say 10 percent of your income – and then readjust your financial compass as you get closer and have more information. You…

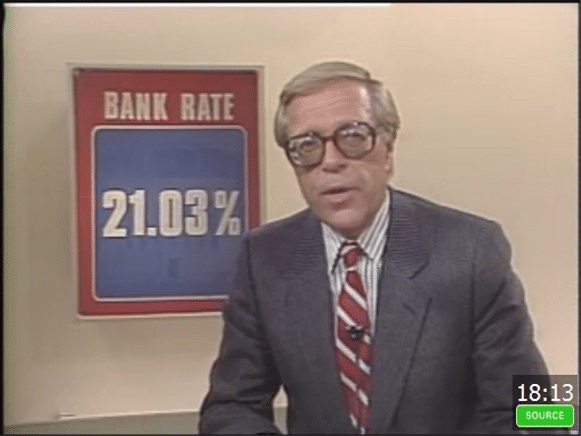

Read MoreWeekend Reading: Rate Hike Drama Edition

As was widely predicted, the Bank of Canada raised its key interest rate by 0.25 percent last week, sparking interest rate drama across the nation about what this ‘means for you’, along with cries from mortgage professionals to ‘lock-in your rates’. I suppose it’s newsworthy considering the BoC hadn’t raised rates in seven years, but…

Read MorePersonal Banking Options For Seniors

When my husband turned 60 I was eager to have our banking switched to a seniors plan with all the accompanying benefits. When I worked at the bank that I currently deal with, customers were automatically enrolled into “Plan 60” on their 60th birthday. This meant all kinds of perks including no-fee chequing, drafts and money…

Read MoreSudden Money: How To Manage A Financial Windfall

Odds are that at some point you will receive a financial windfall. Windfalls can come from lots of different sources; inheritance, divorce settlement, insurance proceeds, sale of small business, severance or retirement package and, yes, a lottery win. It may seem like a problem you’d love to have, but it can be life changing, and…

Read MoreWeekend Reading: Bank of Canada Rate Hike Edition

The Bank of Canada is widely expected to raise its key interest rate for the first time in nearly seven years when it meets next week (July 12th). Strong economic growth and job numbers have paved the way for the central bank to finally signal a rate increase, even if it’s just a moderate 25…

Read MoreAsk A Career Expert: Negotiating A Job Offer (Sample Script)

Last month we talked about the importance of negotiating a job offer and why we should do it. Today, we will talk about how to actually ask a company for more money with a sample script. It’s not as hard as you think it is. The key is to be prepared and remove emotion from…

Read MoreAre Your Assets Under Management Really Being Managed?

Many investors don’t have the time, inclination, or ability to handle their own investing. Once their portfolios reach a certain level they decide to rely on an investment adviser or wealth manager. After all, these “experts” are supposed to have superior knowledge. What do you get from these advisers? Are your best interests in mind?…

Read More