Weekend Reading: Million Dollar Bet Edition

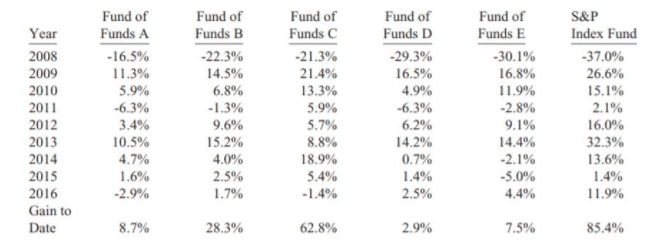

It’s over. Mercy rule in effect. The losing side took their ball and went home. At the end of 2007, investing legend Warren Buffett famously made a million dollar bet with hedge fund manager Ted Seides of Protégé Partners. Buffett wagered that a low-cost S&P 500 index fund would perform better than a group of…

Read More10 Items To Consider Buying Used (Plus 5 Things I’d Never Buy Used)

Buying used items can be one of the biggest ways to save money. A report by Kijiji states that the average Canadian family of four saves about $1,150 each year buying second-hand items. If you want to try your hand at golf, or need a bicycle, exercise equipment, or a TV stand, why not look…

Read More5 Financial Traps Seniors Fall Into And How To Avoid Them

Scott Terrio’s Twitter feed reads like a financial horror story. Terrio, an insolvency expert at Cooper & Co. in Toronto, uses the 140-character medium to share the multitude of ways seemingly well-off Canadians end up buried in debt and turning to debt consolidation, consumer proposals, and even bankruptcy. Canada’s record household debt levels have been…

Read MoreWeekend Reading: Unpopular Opinions Edition

I grew up in Calgary in the 1980s and became a huge Calgary Flames fan at a young age (’89 baby!). The Flames organization, like many Canadian sports teams, struggled in the 1990s as the league expanded and the Canadian dollar sunk below 70 cents (player wages are paid in U.S. dollars). By 1999, attendance…

Read MoreRetirement Planning Advice For Singles

Retirement planning advice for singles is similar to that for couples – track your expenses, clear up debt, automate your savings, and keep investment costs low. However, being single, whether by choice, or as a result of being widowed or divorced, presents some financial planning challenges. The biggest challenge of being a single person is…

Read MoreHow To Convert Your RRSP To A RRIF

When I worked in banking, on December 31 we usually closed the branch at 3 pm so us bankers could get a head start on our New Year’s Eve partying. One year, at about 2:55 pm, a fellow sat down in my office and told me he needed to convert his RRSP to a RRIF.…

Read MoreWeekend Reading: Calgary Meet-Up Edition

Welcome to our latest edition of weekend reading. We’ve got a busy week ahead, with a Calgary meet-up at the new Tangerine cafe on 17th Avenue, the Canadian Financial Summit (where you can learn more about my four-minute investment portfolio), and a Twitter chat about TFSAs. In addition, I’ll have a new Toronto Star article…

Read MoreBuilding Your Wealth: What You Need To Know Before Investing In Mutual Funds

An investment is an asset or item that is purchased with the hope it will generate income or will appreciate to create future wealth. There are lots of types of investments – from stocks and bonds, antiques, art and collectibles, and real estate. All investments have different ways of being selected and purchased, and each…

Read More5 Keys To Becoming Financially Free

We want to be financially free by the time I reach 45. That freedom will allow us to pursue our passions much earlier than traditional retirement age. To get there we’ll need to be debt-free and have sufficient assets and other income producing endeavours to allow me to leave full-time employment behind. Unlike some early…

Read MoreWeekend Reading: End Of Summer Edition

Our kids go back to school next week and so this officially marks the last weekend of summer for parents. We’re very excited to have a brand new elementary school open this year right down the street from us, which means no more early mornings waiting for the bus. Our oldest enters grade three this…

Read More