Striking A Balance Between Risk And Reward

I read this story about a couple planning their wedding – let’s call them Carl and Vanessa. Vanessa wanted the ceremony to be held in a park next to a lake, but it would be several kilometres from town. The problem, practical Carl said, was there were no buildings in the vicinity should the weather…

Read MoreWhat Self-Employed Canadians Need To Know When Filing Their Taxes

In today’s economic reality, young workers often have to settle for short-term contracts while earning less than they desire. Many turn to freelancing – the gig economy – or full-fledged self-employment to pay the bills. Having business income, or multiple streams of income, can present a challenge come tax-time. Here’s what self-employed Canadians need to…

Read MoreWeekend Reading: Investor Buyer Beware Edition

Online brokerages are strictly prohibited from providing advice, yet many still offer mutual funds that come with trailer fees – which are in place to charge for ongoing advice. See the dilemma? DIY clients who purchase these mutual funds are being charged for advice they cannot and will not receive. Recently, a proposed class action…

Read MoreDo You Wait Until The Last Minute To File Your Taxes?

Did you file your taxes yet? You’re not alone. More than one-quarter of Canadians — 28 per cent — find the tax-filing process stressful, confusing and even intimidating, according to a TD survey. Most Canadian income tax returns (and balances owing) are due by midnight April 30, 2018. I’m a terrible procrastinator and I tend…

Read MoreBuild Flexibility Into Your Retirement Plan

Prospective retirees want a simple formula for making their retirement plan. There are hundreds of calculators that will crank out numbers showing how many years until you can retire, how much you need to save, and how long your money will last. It’s a good place to start, but don’t stake your entire future on…

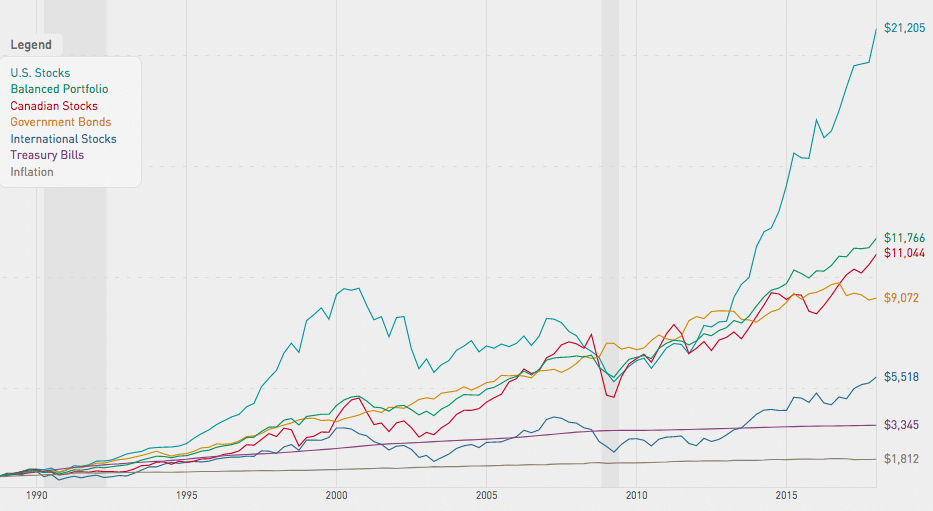

Read MoreInvesting In Retirement: How Much Money Should You Keep In Stocks?

Much is written about investing during your working years, but surprisingly little about investing in retirement. How much money should you keep in stocks after retirement? One rule of thumb says the percentage of equities in your portfolio should equal 100 or 110 minus your age, meaning someone turning 70 would have just 30 to…

Read MoreWeekend Reading: Until Markets Settle Down Edition

I guess it’s only human nature to get skittish whenever markets fall. Those feelings are exasperated for investors who have yet to experience a true bear market (2000, 2008). This year has been particularly difficult for neophyte investors who haven’t yet learned the patience and discipline of a long-term investor. For example, on any given…

Read MoreApril Is A Good Month To Do These Things

Bye bye winter blues. Warm weather is approaching soon (I hope). When the weather starts warming up in April my thoughts turn to spending more time outdoors. Garden centres are opening, and many campgrounds are already accepting reservations, giving us something to look forward to. This year, admission to Parks Canada is free for kids…

Read MoreWillful Review: Online Wills For $99

This is a review of Willful Wills, a digital platform where clients can create a will online for as little as $99. (Boomer & Echo readers will receive 10% off any Willful plan purchase by entering the promo code: Boomer.) Technology disrupts many industries by driving down costs and increasing accessibility. Just like how Netflix…

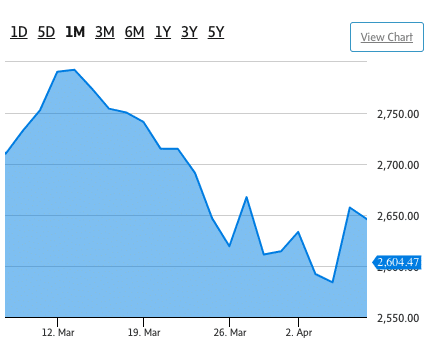

Read MoreWeekend Reading: What Market Volatility Edition

The first quarter of 2018 was a tough one for investors. It started on February 5th with the worst single-day point drop in history for the Dow Jones Industrial Average, which fell 1,175 points that day. Indeed, market volatility was back and, according to some pundits, here to stay. Stock markets can be manic, prone…

Read More