Debt Avalanche vs. Debt Snowball: When Math Trumps Behaviour

John and Erica Mullen are in their mid-thirties and have two young children at home. Together they earn well over $100,000 per year, but a combination of poor choices and unlucky circumstances have left them buried in debt. Their substantial income affords them the luxury of not having to turn their life upside down by…

Read MoreWeekend Reading: Kelowna Getaway Edition

A work conference had me off to Kelowna for two days of meetings. Trouble is, I’d miss my daughter’s birthday. Not cool. The solution: Bring the whole family out for a bit of a getaway prior to the conference. We love to escape to the Okanagan once every year or so. What’s not to love?…

Read MoreMay Is A Good Month To Do These Things

In the early 1990’s, a phrase came into being: “The Mother of all….” to mean the ultimate. This is a nod to the power of motherhood. Mother’s Day is a salute to all moms. Caring children make it a point to pamper their mothers with gifts, brunch or breakfast in bed. Sales of cards break…

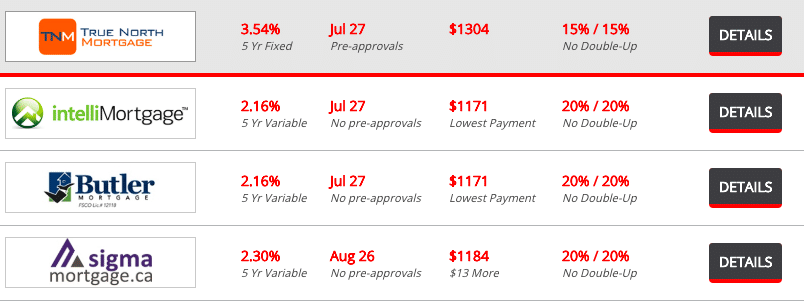

Read MoreShould You Use An Online Mortgage Broker?

When I wrote about my mortgage renewal strategy last week a reader asked if it was a good idea to visit a rate comparison website and simply select the lender with the lowest rate. No doubt if you frequent these sites you’ll have noticed the lowest mortgage rates tend to come from online mortgage brokers…

Read MoreWeekend Reading: Financial Literacy Progress Edition

Financial literacy leader Jane Rooney released a two-year progress report on the advancements in financial literacy research in Canada. The National Strategy was created to mobilize and engage public, private and non-profit sectors to strengthen the financial literacy of Canadians and empower them to manage money and debt wisely; plan and save for the future; and…

Read MoreDownsizing Retirees: Should You Own Or Rent?

There’s been a lot written about the advantages of renting rather than owning a home for young people as they try to find the right balance between their financial situations and their housing needs. These days many older homeowners are struggling with this decision too. Empty nesters are thinking, “Our 5-bedroom house is too large…

Read MoreHow To Save On Meat And Produce

Meat and produce take up a big chunk of our grocery bill. According to Statistics Canada, Canadians spend nearly 20 percent of their food budget on red meat and chicken. Fruits and vegetables take up almost 24 percent of the grocery list. Here’s how to save money on meat and produce: Cut down on meat…

Read MoreMy Mortgage Renewal Strategy

Our mortgage comes up for renewal on September 1st. When we bought our home in 2011 I went with a five-year discounted variable rate mortgage at prime minus 0.80 percent. Such a steep discount wasn’t available when it was time to renew in 2016, so I chose a 2-year fixed rate mortgage at 2.19 percent.…

Read MoreWeekend Reading: Aeroplan Woes Edition

My wife and I are saving for a big trip next year – our dream vacation to Ireland. While we’re light on trip details right now I’m busy thinking about the best way to get us there. One option is to use Aeroplan miles. We have approximately 160,000 Aeroplan miles right now and we could…

Read MoreSimpleTax vs. TurboTax: Free Tax Software Comparison

Canadian taxpayers have until April 30th to submit their personal taxes for the previous year. Despite that deadline fast approaching many wait until the last minute to prepare and file their taxes. The good news for do-it-yourself tax filers is that basic tax preparation software can be free and rather intuitive to use. While some…

Read More