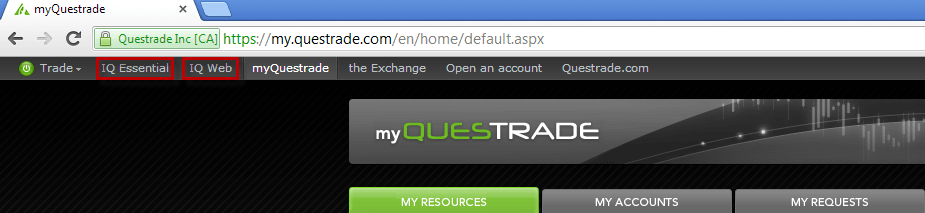

Questrade Tutorial: How To Use The Trading Platform

Questrade is best known for offering rock-bottom commissions for trading stocks. You can buy and sell individual stocks for as low as $4.95 per trade. Questrade even introduced commission-free purchases for any ETF in North America. You can open your own self-directed investing account with Questrade with as little as $1,000. Unlike the big discount…

Read MoreWeekend Reading: Maui Edition

Aloha! We’ve spent the past week in Maui escaping the cold winter back home and taking a much needed break. The past few months have been stressful and anxiety-ridden as I transitioned from a day job + side hustle to full-time entrepreneur. I’m happy to say that life as an online entrepreneur is going better…

Read MoreWeekend Reading: Free CPP Calculator Edition

One of the biggest decisions retirees face is when to take their Canada Pension Plan (CPP) benefits. There’s a case to be made for deferring CPP until age 70, or taking CPP at 60, or somewhere in between (like the standard age 65). You can view your estimated monthly CPP benefits online using your My…

Read More4 Big Rip-Offs To Avoid

I’ve made my share of bad financial decisions over the years, but nothing feels worse than when a salesperson convinces you to buy something that’s not in your best interest. These kinds of rip-offs usually occur when one party has more or better information than the other. Think about the first time you bought a…

Read MoreRRSPs Are Not A Scam: A Guide For The Anti-RRSP Crowd

“I don’t invest in my RRSP anymore because I’ll have to pay tax on the withdrawals.” This type of thinking around RRSPs has become increasingly common since the TFSA was introduced in 2009. The anti-RRSP crowd must come from one of two schools of thought: They believe their tax rate will be higher in the…

Read MoreWeekend Reading: High Interest Savings War Edition

Savers rejoice! We’re in the midst of a high interest savings war. The battle for your business isn’t being fought by the big banks, but by upstart FinTech companies looking to build up deposits. Indeed, the big five have mostly ignored the high interest savings account market. Why bother, when they’re hauling in record profits…

Read MoreWeekend Reading: Are We Due For A Correction Edition

2019 was a terrific year for stock market returns. This bull market has gone on for so long now that investors can’t help but wonder, are we due for a correction this year or in the near future? It’s a question I get a lot from my clients these days, especially the soon-to-be-retired and the…

Read MoreMy Mortgage Gambit: How (And Why) I Loaned Myself A Mortgage From My LIRA

This is a reader story from Kevin in Toronto, who, after getting laid off, took an unconventional approach with his locked-in retirement account (LIRA) – paying off his mortgage and then setting up a LIRA mortgage. What are the pros and cons of loaning yourself a mortgage from your RRSP or LIRA? Read on for…

Read MoreWeekend Reading: Worst Financial Planning Fears Edition

What are your worst financial planning fears? Some answers may include longevity risk (outliving your money), sequence of returns risk (the impact that negative stock market returns has on your withdrawal strategy), or poor investment performance (earning a lower rate of return than you expected). A recent discussion on Twitter teased out more answers from…

Read MoreHe Bet The Farm On Weed Stocks And Won. Then Watched It Burn To The Ground

The following story is from Nick, whose investing journey began when he bet the farm (and won) on weed stocks, then watched in horror as that same barn burned to the ground several months later. You can follow his portfolio and journey for redemption at LateCycle.com – or on Twitter (@latecycle_nick). It’s one o’clock in the…

Read More