Posts by Robb Engen

How Much Do You Need To Save For Retirement?

In your 20’s and 30’s, retirement is so far away that you can barely see it on the horizon. The best way to get there is to save what you can afford – say 10 percent of your income – and then readjust your financial compass as you get closer and have more information. You…

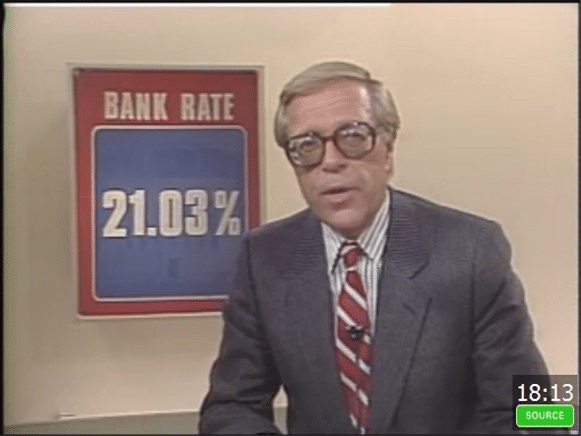

Read MoreWeekend Reading: Rate Hike Drama Edition

As was widely predicted, the Bank of Canada raised its key interest rate by 0.25 percent last week, sparking interest rate drama across the nation about what this ‘means for you’, along with cries from mortgage professionals to ‘lock-in your rates’. I suppose it’s newsworthy considering the BoC hadn’t raised rates in seven years, but…

Read MoreWeekend Reading: Bank of Canada Rate Hike Edition

The Bank of Canada is widely expected to raise its key interest rate for the first time in nearly seven years when it meets next week (July 12th). Strong economic growth and job numbers have paved the way for the central bank to finally signal a rate increase, even if it’s just a moderate 25…

Read MoreA Lannister Always Pays His Debts (And So Should You)

In Game of Thrones, the Lannisters are the wealthiest and most powerful family in the Seven Kingdoms. They’re not afraid to leverage their wealth to forge key alliances and advance their political agenda. But, despite being known for plotting and treachery, the unofficial motto for the family is, “A Lannister always pays his debts.” Unless…

Read MoreWeekend Reading: Canada 150 Edition

Happy Canada Day! We hope you all get a chance to enjoy the Canada 150 celebrations happening across the country. We’re driving southwest to Waterton Lakes National Park to hike The Bear’s Hump and take in the beautiful scenery at this UNESCO World Heritage Site. We’ll also check out Red Rock Canyon and hopefully spot…

Read MoreNet Worth Update: 2017 Mid-Year Review

We’re nearly halfway through the year and so it’s time for my bi-annual net worth update and review for 2017. I was happy to surpass the $500,000 net worth milestone last year and, after paying off our car loan in October, looked forward to cranking up our savings rate and refilling our TFSAs this year.…

Read MoreWeekend Reading: The Canada Project Edition

The Canada Project, a survey launched by Maclean’s to mark Canada’s 150th birthday, explores what Canadians love about their country, and what they’d like to see improve. There’s some fascinating information coming out of the survey: how we feel about travel and transportation, about our patriotic drinking habits, and why we hate Nickelback. Several other…

Read MoreHow We Save For A Spend-y Summer

Pay yourself first. It’s one of the core tenets of personal finance. Treat your savings like an obligation – your number one priority, in fact – and you can spend what’s left in your bank account guilt-free. I’m a bit of a misfit when it comes to saving money. I don’t actually pay myself first…

Read MoreWeekend Reading: Checking In On My Goals Edition

We’re almost halfway through 2017 already and it’s a good time to reflect on my financial goals for the year and check in on my progress. To summarize, I wanted to max-out all of my unused RRSP contribution room, start catching up on TFSA contributions, pay off our home equity line of credit, max-out the…

Read MoreSimply Making The Most Out Of Summer Spending

Let’s talk about summer spending. For us, summer is the most expensive season and one that can get out of control quite easily without a sensible spending plan to guide us. In addition to our summer vacation, there are day-trips to the mountains, summer camps for the kids, lawn care, backyard barbeques, plus the odd…

Read More