Posts by Robb Engen

Weekend Reading: What’s Keeping Us Awake At Night Edition

A thoughtful, well-written essay by Bank of Canada Governor Stephen Poloz highlights this edition of weekend reading. The Governor spoke before the Canadian Club in Toronto and shared that while the Canadian economy is on pace to be the strongest among the Group of Seven economies this year there are still three (or four) things…

Read MoreThe Illusion Of Wealth

Would you prefer a lump sum of $300,000, or its equivalent monthly income stream of $1,000 for life? If $300,000 seems larger and more appealing to you than the monthly amount then you might exhibit a phenomenon known as the illusion of wealth. A 2014 study looked at the illusion of wealth and how it…

Read MoreWeekend Reading: Your Trusted Advisor Edition

The financial services industry is in dire need of change. It’s such a me-too industry brainwashed to believe that all you need is a regular meeting with your trusted advisor and your financial literacy problems will be solved. Look no further than the 100+ comments to Rob Carrick’s question on LinkedIn, wanting to hear fresh…

Read MoreWeekend Reading: Realtors Run Amok Edition

We live in the information age and yet in certain industries the information gap between the buyer and seller remains a mystery. The financial industry attempted to rectify the problem by introducing CRM2, which discloses how much investors pay advisors and their firms – and expressing those fees in dollars rather than as a percentage…

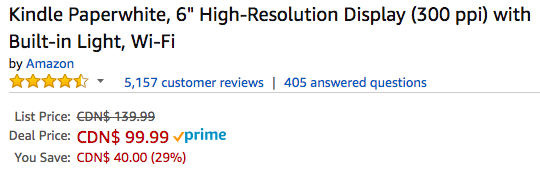

Read MoreWeekend Reading: The Black Friday Edition

Ahh, Black Friday. The day for personal finance experts to get up on their soap-boxes and preach about the evils of consumerism and spending. It’s also the time for news media to reach out to said experts and get their ‘tips and tricks’ to combat the evil forces of The Black Friday, as if we’ll…

Read More3 Ways For Investors To Get International Diversification

Many Canadian investors suffer from home country bias by holding all, or a large portion of, their investments in Canadian stocks. This makes little sense for those looking to build a diversified portfolio. Canada makes up just 3 percent of the world’s market capitalization and its markets tilt heavily towards financials (banks & insurance) and…

Read MoreDollars and Sense: Book Review and Giveaway

Most personal finance literature focuses on the numbers. How much you need to save, where to find the best deals, which investments earn the highest return, why you should pay off your high interest debt first. But there’s a growing body of work exploring our financial behaviour and why certain decisions about money are made…

Read MoreWeekend Reading: Exploding Sunroof Update Edition

Long-time readers might recall last summer when the panoramic sunroof in our 2013 Hyundai Sante Fe spontaneously shattered while my wife and I were driving on the highway towards Lethbridge. I filed a complaint with Transport Canada, and after searching online and finding multiple instances of exploding sunroofs, wondered why a recall hadn’t been ordered.…

Read MoreWeekend Reading: CPP Reality Check Edition

Repeat after me: The Canada Pension Plan will be there for me when I retire. In fact, CPP is sustainable over the next 75 years according to the most recent report issued by Canada’s Chief Actuary. This projection assumes a modest 3.9 percent annual real rate of return over that time. The plan is operated…

Read MoreWeekend Reading: How Much Should We Save Edition

Financial writer Jean Chatzky caused an uproar this week when she tweeted some advice on age-based savings benchmarks that, to some, seemed unattainable. By the time you’re 30, aim to have 1x your annual income set aside for retirement. At 40, 3x; at 50, 6x; at 60, 8x; and by retirement, 10x. — Jean Chatzky…

Read More