Posts by Robb Engen

Weekend Reading: Crypto Crazy Edition

This time is different – the four most dangerous words when it comes to investing. We’ve seen it time and time again. From Tulip Bulb Mania to the Dot Com Era, and the U.S. Housing Boom, exuberant market behaviour drives asset prices higher and higher until demand reaches levels that can no longer be sustained,…

Read MoreCredit Cards With No Foreign Currency Conversion Fees. What Are My Options?

Amazon.ca Rewards Visa and Marriott Rewards Premier Visa cardholders recently received a letter from their card issuer, Chase Canada, advising that these cards will be deactivated as of March 15th, 2018. It’s a disappointing, but not surprising exit for Chase, which sold its Sears MasterCard portfolio and related credit card operations; including a call centre,…

Read MoreWeekend Reading: Bank of Canada Hikes Rates (Again) Edition

The Bank of Canada raised its key interest rate again this week, marking the third time since last summer that they’ve increased the benchmark lending rate. It now sits at 1.25 percent, while Canada’s big banks all moved their prime ending rate to 3.45 percent. The move has financial experts warning of the impact on…

Read MoreLearn How To Budget (And Download A Free Budgeting Spreadsheet)

I learned how to budget and got my finances under control back in 2009. Up until then I was like most working Canadians; my paycheque would come in, I’d pay some bills, go grocery shopping, maybe transfer some money into savings, and then (over)spend the rest on whatever. A budget not only helped track my…

Read MoreWeekend Reading: Couch Potato Edition

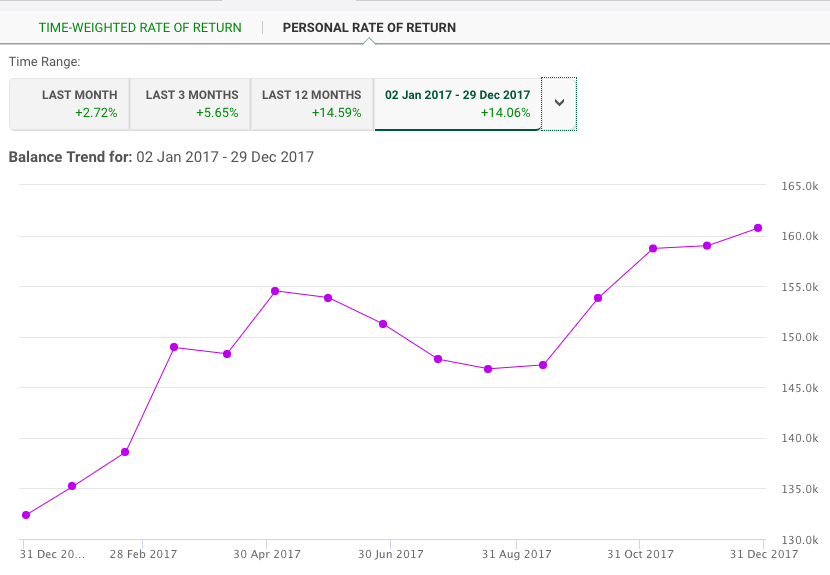

Canadian Couch Potato godfather Dan Bortolotti recently posted the returns for his three model portfolios. Like my two-ETF portfolio, which returned 14.06 percent, Dan’s model portfolios had a banner year in 2017. Here are the results for the most aggressive versions of each portfolio: Tangerine’s Balanced Growth Portfolio – 9.5 percent TD’s e-Series Funds –…

Read MoreHow AI Can Help You Find & Save More Money

If you’ve been reading this blog long enough you’ll know that I’m a big fan of behavioural finance – that is, combining psychology and economics to help us understand why we make irrational decisions about money. This relatively new field of study has produced ground breaking research and insight that has already made a big…

Read More3 Years Ago I Switched To Indexing. Here’s How My Portfolio Performed

On January 7th, 2015 I sold 24 Canadian dividend stocks worth about $100,000 and bought two low-cost index ETFs (Vanguard’s VCN and VXC). It was a bold move to switch to indexing after years of dividend growth investing. Lots of people questioned my decision. I even lost blog readers because of it (seriously). But it…

Read MoreWeekend Reading: Happy New Year 2018 Edition

Happy new year and welcome back to another edition of weekend reading – the first of 2018! We’ve got a lot in store for you this year as we continue to share our money stories and help you achieve your financial goals. As always, we’re happy to take your topic suggestions so leave a comment…

Read MoreNet Worth Update: 2017 Year-End Review

The end of the year is a great time to review your finances and update your net worth. I’m a personal finance nerd, which means I update our net worth every month or so, and I publish a net worth update here twice a year. At the midway point this year our net worth had…

Read MoreWeekend Reading: Merry Christmas Edition

Merry Christmas, everyone! Welcome to the last edition of weekend reading for 2017. We’re taking Christmas week off and I’ll be back next weekend to update my net worth for the year. As always, thank you for following our journey towards financial freedom. We feel incredibly honoured that each of you choose to spend a…

Read More