Posts by Robb Engen

Weekend Reading: Kelowna Getaway Edition

A work conference had me off to Kelowna for two days of meetings. Trouble is, I’d miss my daughter’s birthday. Not cool. The solution: Bring the whole family out for a bit of a getaway prior to the conference. We love to escape to the Okanagan once every year or so. What’s not to love?…

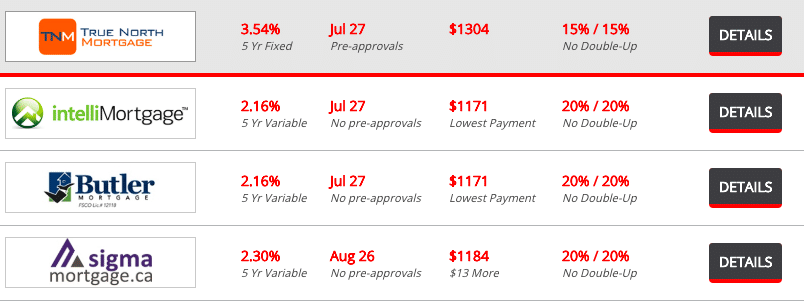

Read MoreShould You Use An Online Mortgage Broker?

When I wrote about my mortgage renewal strategy last week a reader asked if it was a good idea to visit a rate comparison website and simply select the lender with the lowest rate. No doubt if you frequent these sites you’ll have noticed the lowest mortgage rates tend to come from online mortgage brokers…

Read MoreWeekend Reading: Financial Literacy Progress Edition

Financial literacy leader Jane Rooney released a two-year progress report on the advancements in financial literacy research in Canada. The National Strategy was created to mobilize and engage public, private and non-profit sectors to strengthen the financial literacy of Canadians and empower them to manage money and debt wisely; plan and save for the future; and…

Read MoreMy Mortgage Renewal Strategy

Our mortgage comes up for renewal on September 1st. When we bought our home in 2011 I went with a five-year discounted variable rate mortgage at prime minus 0.80 percent. Such a steep discount wasn’t available when it was time to renew in 2016, so I chose a 2-year fixed rate mortgage at 2.19 percent.…

Read MoreWeekend Reading: Aeroplan Woes Edition

My wife and I are saving for a big trip next year – our dream vacation to Ireland. While we’re light on trip details right now I’m busy thinking about the best way to get us there. One option is to use Aeroplan miles. We have approximately 160,000 Aeroplan miles right now and we could…

Read MoreSimpleTax vs. TurboTax: Free Tax Software Comparison

Canadian taxpayers have until April 30th to submit their personal taxes for the previous year. Despite that deadline fast approaching many wait until the last minute to prepare and file their taxes. The good news for do-it-yourself tax filers is that basic tax preparation software can be free and rather intuitive to use. While some…

Read MoreWhat Self-Employed Canadians Need To Know When Filing Their Taxes

In today’s economic reality, young workers often have to settle for short-term contracts while earning less than they desire. Many turn to freelancing – the gig economy – or full-fledged self-employment to pay the bills. Having business income, or multiple streams of income, can present a challenge come tax-time. Here’s what self-employed Canadians need to…

Read MoreWeekend Reading: Investor Buyer Beware Edition

Online brokerages are strictly prohibited from providing advice, yet many still offer mutual funds that come with trailer fees – which are in place to charge for ongoing advice. See the dilemma? DIY clients who purchase these mutual funds are being charged for advice they cannot and will not receive. Recently, a proposed class action…

Read MoreInvesting In Retirement: How Much Money Should You Keep In Stocks?

Much is written about investing during your working years, but surprisingly little about investing in retirement. How much money should you keep in stocks after retirement? One rule of thumb says the percentage of equities in your portfolio should equal 100 or 110 minus your age, meaning someone turning 70 would have just 30 to…

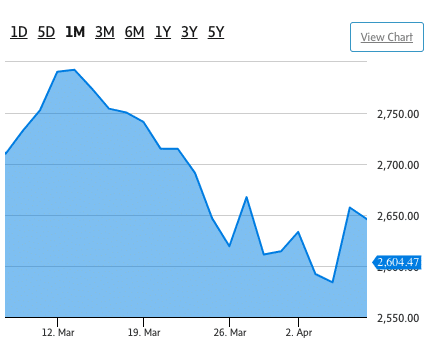

Read MoreWeekend Reading: Until Markets Settle Down Edition

I guess it’s only human nature to get skittish whenever markets fall. Those feelings are exasperated for investors who have yet to experience a true bear market (2000, 2008). This year has been particularly difficult for neophyte investors who haven’t yet learned the patience and discipline of a long-term investor. For example, on any given…

Read More