Posts by Boomer

Old Age Security (OAS) Explained

Old Age Security (OAS) was originally intended to be a universal program to provide income support payments to Canadian seniors. It is one of the cornerstones of Canada’s retirement income system. It is not a pension plan. You don’t make contributions. OAS is a government benefit program that is financed out of general revenue. Employment…

Read More3 Reasons Why DIY Investors Fail

The message is everywhere. You don’t need the input of an investment professional to manage your portfolio. You can easily do it yourself and it takes no time at all. There are many reasons for investors to pursue DIY investing. Perhaps you are tired of paying the high fees for so-so performance with your advisor,…

Read MoreFrom The Boomer & Echo Mailbag: Is Leasing A Vehicle A Smart Option For This Senior?

Q. I am 73 years old with a modest income consisting of a small pension and government benefits. I need a new vehicle and I’m considering leasing instead of dipping into my retirement savings to buy another car outright. Is this a good idea? One-off expenses such as a replacement vehicle should be part of…

Read MoreFinancial Conflicts: When A Spender Partners With A Saver

As part of my budgeting plan, I transfer a set amount every month into my chequing account to pay for the household bills and regular monthly spending. I have this figured out pretty accurately. This month, I was pleasantly surprised to see that I had almost $700 extra – money that wasn’t spent. I told…

Read MorePersonal Banking Options For Seniors

When my husband turned 60 I was eager to have our banking switched to a seniors plan with all the accompanying benefits. When I worked at the bank that I currently deal with, customers were automatically enrolled into “Plan 60” on their 60th birthday. This meant all kinds of perks including no-fee chequing, drafts and money…

Read MoreSudden Money: How To Manage A Financial Windfall

Odds are that at some point you will receive a financial windfall. Windfalls can come from lots of different sources; inheritance, divorce settlement, insurance proceeds, sale of small business, severance or retirement package and, yes, a lottery win. It may seem like a problem you’d love to have, but it can be life changing, and…

Read MoreAre Your Assets Under Management Really Being Managed?

Many investors don’t have the time, inclination, or ability to handle their own investing. Once their portfolios reach a certain level they decide to rely on an investment adviser or wealth manager. After all, these “experts” are supposed to have superior knowledge. What do you get from these advisers? Are your best interests in mind?…

Read MoreWhat Exactly Does Your Home Insurance Policy Cover?

I recently received my home insurance renewal notice. The company I deal with merged (or was bought out?) by another company and the accompanying letter advised reviewing the policy to make sure I was getting the appropriate coverage. Being obsessive that way, I did go through it with a fine-tooth comb. I don’t want to…

Read MoreFrom The Boomer & Echo Mailbag: Understanding Withholding Taxes On Foreign Investments

Q. What types of foreign investments can Canadian investors invest in their RRSP, TFSA and Non-Registered accounts that don’t charge withholding taxes? Canadian investors get enormous benefit from diversifying their portfolios with U.S. and international stocks, but it can come at a cost – foreign withholding taxes. In a nutshell, many foreign countries including the…

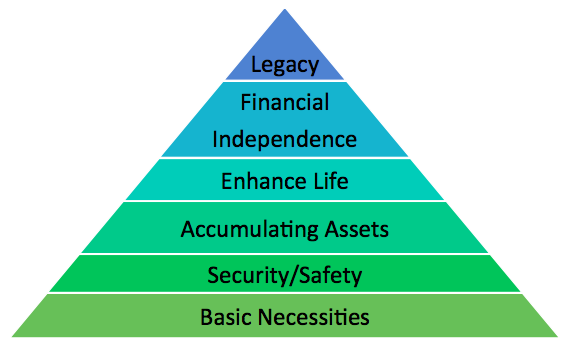

Read MoreThe Hierarchy Of Financial Needs

If you’ve ever taken a psychology course you may be familiar with Abraham Maslow’s Hierarchy of Needs. In ascending order, the needs are: Physiological Safety Social / Belonging Esteem / Achievement Self-Actualization / Reaching your potential The theory states that people need to fulfill their basic needs before devoting energy to the higher levels. So,…

Read More