Archive for January 2018

How AI Can Help You Find & Save More Money

If you’ve been reading this blog long enough you’ll know that I’m a big fan of behavioural finance – that is, combining psychology and economics to help us understand why we make irrational decisions about money. This relatively new field of study has produced ground breaking research and insight that has already made a big…

Read MoreBecoming Retirement Ready

It’s likely that investing for retirement is the most long-range, expensive goal most of us will ever face. In the early years that far off future can be pretty vague, and many of us wait until we actually retire before putting a plan together, if we plan at all. Smart retirees start thinking about what…

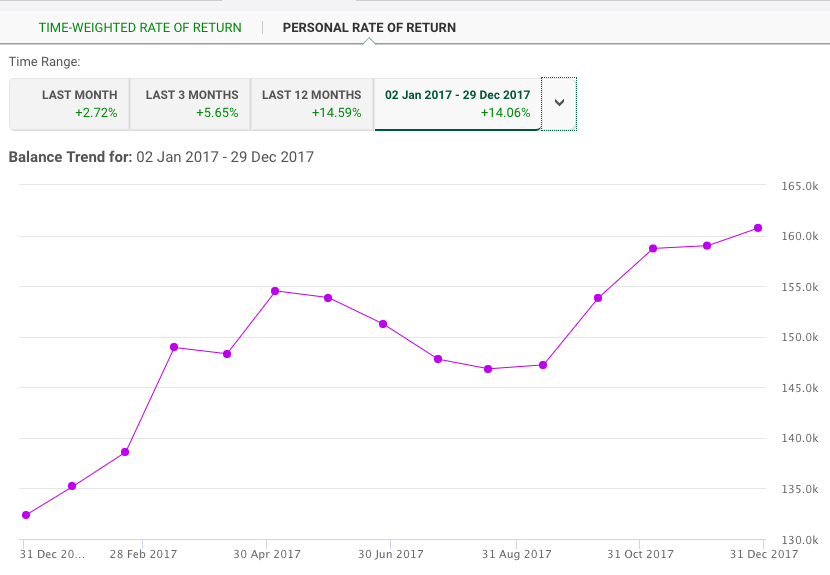

Read More3 Years Ago I Switched To Indexing. Here’s How My Portfolio Performed

On January 7th, 2015 I sold 24 Canadian dividend stocks worth about $100,000 and bought two low-cost index ETFs (Vanguard’s VCN and VXC). It was a bold move to switch to indexing after years of dividend growth investing. Lots of people questioned my decision. I even lost blog readers because of it (seriously). But it…

Read MoreWeekend Reading: Happy New Year 2018 Edition

Happy new year and welcome back to another edition of weekend reading – the first of 2018! We’ve got a lot in store for you this year as we continue to share our money stories and help you achieve your financial goals. As always, we’re happy to take your topic suggestions so leave a comment…

Read More7 Income Splitting Strategies For Families

Our Canadian tax system has graduated tax brackets that result in people with earnings in higher tax brackets paying a greater amount of tax. Income splitting is a tax planning technique designed to shift income from a high-income earning taxpayer to a family member at a lower tax rate. The Income Tax Act has clear…

Read MoreJanuary Is A Good Month To Do These Four Things

January rings in the New Year, a sign of optimism, and the annual promise of something new: adopting resolutions, setting goals and looking ahead. It’s also a time to reflect on the previous year. Making resolutions is common for many, but less than 40% will actually achieve what they set out to do. Nevertheless, for…

Read MoreShould You Be A DIY Online Investor?

With Canadian mutual fund fees amongst the highest in the world according to a 2015 Morningstar Global Fund Survey, and online discount brokerage accounts becoming easier and cheaper to use every year, a savvy investor might want to think about finally making the leap and directly controlling their own investments. While it used to be…

Read More