Inspiring women to confidently manage their money.

Learn to budget, pay off debt, and build wealth while enjoying life on your own terms.

Welcome to

Inspired Budget

The #1 website on the internet where women can come to learn how to manage their money in a totally compassionate, fully supported, non-judgmental environment. At Inspired Budget, we are passionate about helping you feel hopeful and optimistic about your money.

as seen in

New? Get started here:

01

Learn to Budget

Find ways to save money and start building a financial plan for your future. Whether you are a graduate looking to start a new job or a busy adult with children, there are ways to save money every day.

02

Pay Off Debt

Debt can quickly become overwhelming, but there are ways to make this process easier and more manageable, especially if you’re dealing with a large amount of debt. Learn how to pay off debt fast while staying motivated along the way.

03

Save

Learn how to build your emergency fund and save for goals that matter to you. Save money effortlessly with a plan that is unique to you and your goals!.

04

Invest

The easiest way to build wealth is to make sure that your money is working for you, not the other way around Learning to invest doesn’t have to feel intimidating or complicated. It’s a lot easier than you think!

05

Money Tools

You no longer have to log in and out of a million websites to stay on top of your finances. Instead, you can streamline your money routine with my go-to money tools that make managing your finances seamless.

06

Book Allison

From public speaking to hosting trainings for businesses or collaborating with brands, every opportunity that allows me to connect with my audience through inspirational teaching truly lights me up!

The Inspired Budget Podcast

The Inspired Budget Podcast helps women live their best life and reach their money goals. Join me here for inspiring conversations to help you learn more about budgeting, saving money, paying off debt, and investing for your future. You’ll be hearing not only from me, but others along the way that have a story and voice to share.

STREAM ON YOUR FAV PLATFORM

the fan favs!

The Inspired Budget Shop

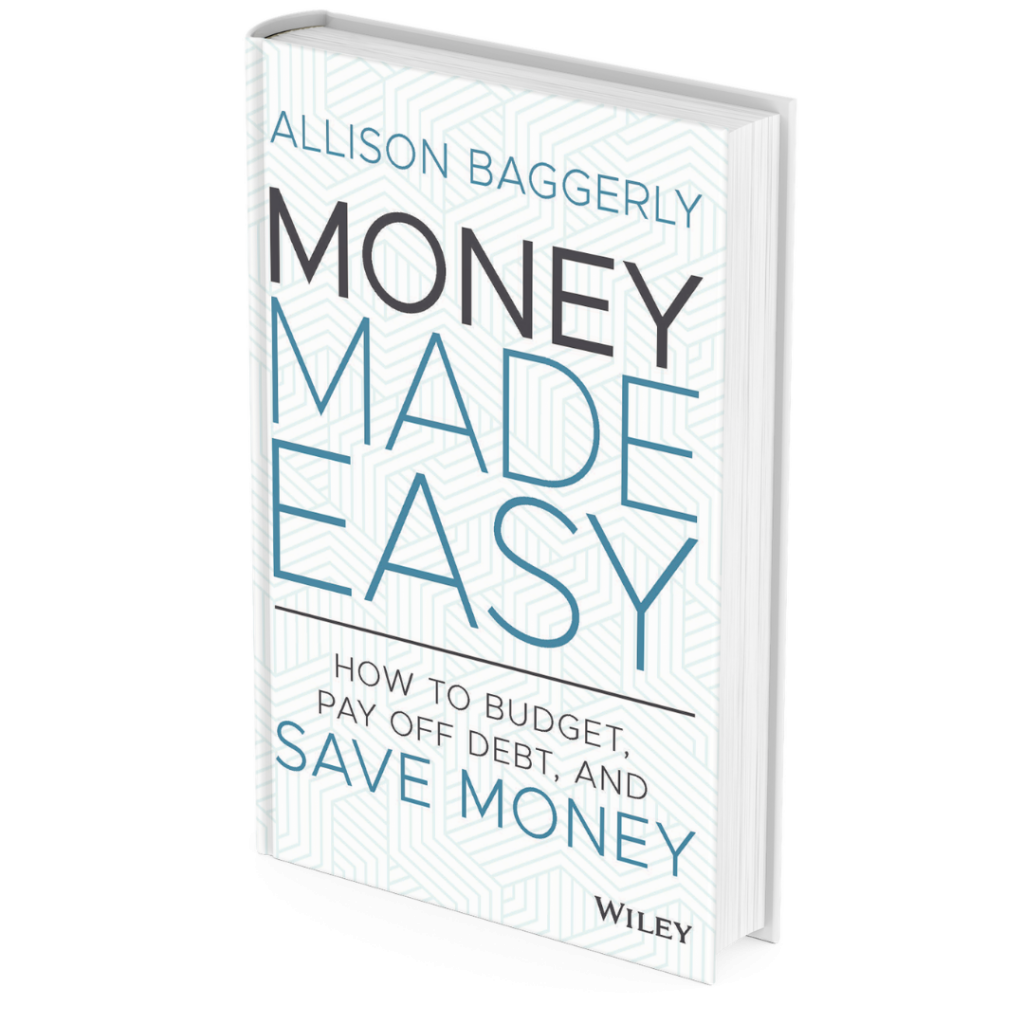

MEET AUTHOR AND PODCAST HOST

Hey, I’m Allison

In 2011 my husband and I were forced to bite the bullet and total up all our debt after we were hit with a life curveball…a positive pregnancy test. This drove us to face our money truth: we had over $111,000 in debt and were living on two teachers’ salaries. The worst part? We didn’t have enough money to pay for daycare.

After the initial wave of nausea (was that morning sickness or panic setting in?), we immediately buckled down and created our first budget…

Budget your way to

wealth

Learn how to budget to build wealth alongside a like-minded community! Get the steps you need to design a budget that works, create your unique debt payoff plan, save money effortlessly, and amplify your money through investing!